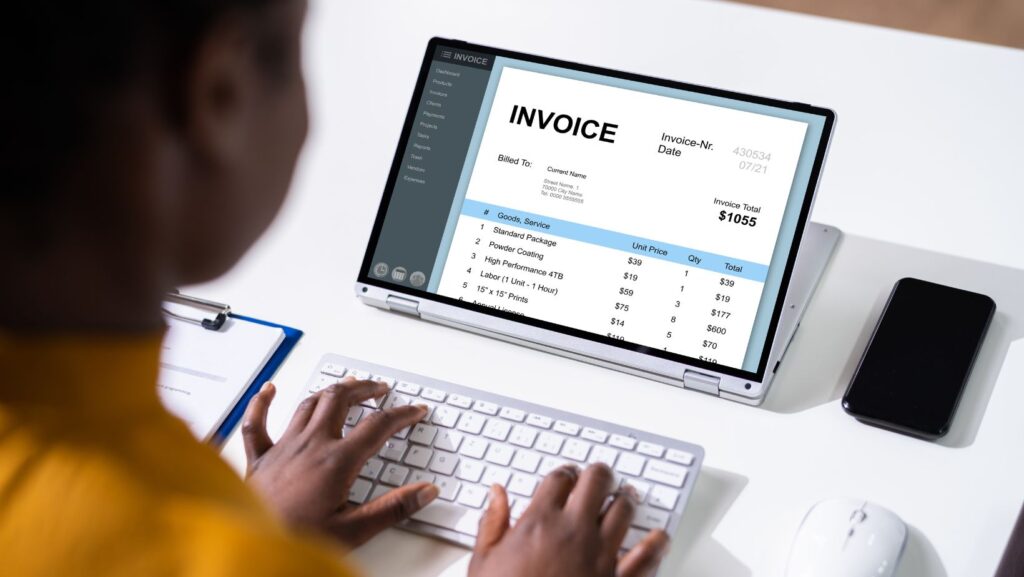

Today’s finance teams face growing pressure to deliver greater efficiency and accuracy while working with limited resources. And with 66% of businesses saying it takes over five days each month just to process invoices. Isn’t it clear there’s a better way to sort this task? That’s why software for invoice processing is quickly becoming one of the fastest-growing solutions for cutting inefficiencies, accelerating workflows, and reducing operational costs.

Moreover, Manual invoicing is prone to data entry errors, approval delays, and compliance risks. But with automation software, businesses can streamline invoice workflows, reduce human error, and maintain better financial control.

This guide explores how invoice processing software works, the key benefits, top tools on the market, and what to look for when choosing the right solution.

Understanding Software for Invoice Processing

Invoice processing software automates the capture, validation, and routing of invoices—from receipt to payment. It eliminates the need for manual data entry and minimizes back-and-forth communication by digitizing and standardizing the entire accounts payable (AP) workflow.

Using AI and OCR (optical character recognition), these tools can read invoices in various formats (PDFs, scans, emails), extract relevant data like invoice number, vendor name, and amount due, then route the invoice to the correct person for review and payment approval.

Key Benefits of Software for Invoice Processing

Software for invoice processing streamlines financial operations and improves business efficiency. Here are the key benefits of using software for invoice processing

1. Faster Turnaround Time

Manual invoice approvals can take days or even weeks. Automated software reduces that to hours. With faster invoice cycles, you can take advantage of early payment discounts and avoid late fees.

2. Reduces Errors

Over 60% of invoice errors stem from manual data entry. By automating this step, invoice processing tools significantly reduce typos, duplicates, mismatches, and everyday issues that lead to delays or incorrect payments.

3. Better Compliance and Audit Trails

Top software solutions keep a complete log of every invoice action, when it was received, who reviewed it, and when it was paid, helping you stay compliant with internal policies and regulatory standards.

4. Cost Savings

A survey by the Aberdeen Group found that the average cost of processing an invoice manually is $15. This process is time-consuming and resource-heavy, but automation can reduce these costs by as much as 80%. When your finance team spends less time tracking down approvals or fixing errors, they have more time for strategic work.

5. Scalability

Whether you process 500 invoices a month or 50,000, automation tools scale effortlessly, something spreadsheets and emails can’t do.

With all these advantages in mind, it’s clear that adopting the right software can transform your invoice processing. Now, let’s take a look at some of the top software options available for businesses today.

7 Top Software for Invoice Processing

Here are some of the best software for invoice processing tools in the market, starting with Docsumo.

1. Docsumo

Docsumo is the highest-rated tool for intelligently processing unstructured documents. It lets you extract, validate, and process invoice data in seconds with over 99% accuracy. It offers three pricing packages based on page limits: Free (100 pages at $0 per month), Growth (1,000 pages at $299 per month), and Enterprise (custom page limits and pricing).

Docsumo offers a pre-trained API for invoice processing, along with automatic document classification and splitting. It exports data based on predefined rules and integrates smoothly with CRMs, ERPs, accounting, and payroll systems.

That said, training Docsumo’s AI models can be time-consuming, and its categorization feature may struggle with invoices that have significant variability. Improperly trained AI models can lead to inaccuracies, making this tool less ideal if you need quick setup and fast implementation.

2. SAP Concur

SAP Concur is a comprehensive solution for managing travel, expenses, and invoices. It automates expense reporting, vendor management, and invoice processing, helping businesses reduce errors and ensure timely payments.

The tool offers vendor payment optimization, global invoice capture, policy compliance checks, and advanced approval workflows to streamline accounts payable. It integrates seamlessly with SAP ERP systems for unified financial management, with pricing available upon request.

3. Rossum.ai

Rossum is a cloud-native, AI-powered document processing tool designed to simplify invoice management workflows. Using its self-learning algorithms and the Rossum Aurora AI engine, it offers a customizable user interface that adapts to changes in invoice formatting and layout.

However, there are some downsides to consider. The initial setup can be complex, and accuracy may be an issue, especially with non-English documents. Additionally, the tool requires some coding knowledge to fully maximize its capabilities. Pricing starts at $18,000 per year for its Starter package.

4. BILL (formerly Bill.com)

Bill.com is a tool tailored to automate both accounts payable (AP) and accounts receivable (AR) processes, making it ideal for businesses that handle a high volume of invoices. It includes features like electronic invoicing, online payments, and approval workflows.

It is best suited for small businesses and entrepreneurs in the US and Canada. Bill.com offers a wide range of invoicing options, an intuitive interface, and a comprehensive toolkit beyond basic invoicing. However, it’s worth noting that many of the advanced features are available only in the paid versions of the platform.

5. Stampli

Stampli is an AI-powered invoice processing platform that streamlines accounts payable (AP) workflows by automating invoice capture, coding, routing, and approvals. Its virtual assistant, Billy the Bot, boosts efficiency by handling routine tasks like fraud detection and invoice processing, reducing manual effort and speeding up operations.

A key advantage of Stampli is its centralized platform for managing all invoice-related activities. It integrates seamlessly with over 70 ERPs, ensuring smooth data syncing, eliminating duplicate entries, and simplifying reconciliations. Stampli offers customized pricing based on business size and needs.

6. Airbase

Airbase is a finance management tool that combines invoice processing with expense management. Key features include accounts payable automation, guided procurement, corporate card management, vendor management, receipt handling, and spend analytics, along with security and fraud detection.

However, Airbase may not be ideal for large, multi-entity, or multi-regional businesses, as its invoice processing and virtual card setup are limited by region. Additionally, users often find the platform slow and the training and support insufficient. It offers three default packages: Standard (up to 200 employees), Premium (up to 500 employees), and Enterprise (up to 10,000 employees), with custom packages available on request.

7. Sage Intacct

Sage Intacct is a cloud-based financial management software that supports functions like accounts payable and receivable, general ledger, financial analysis, and multi-entity management. Pricing is customized and available upon request.

For invoice processing, it uses AI automation to extract data, create pre-filled drafts, and auto-match transactions, streamlining reconciliation. Users can set spending limits and track invoices with clear audit trails, though some reviews mention that it can be costly.

Key Considerations When Choosing Software for Invoice Processing

Choosing the right software for invoice processing isn’t just about ticking boxes—it’s about finding a solution that fits your business model, growth plans, and compliance needs.

Here’s what to consider.

1. Data Accuracy and AI Capabilities

Look for software that offers high accuracy in data capture—even from unstructured or poorly scanned documents. AI-powered tools can adapt and improve over time, offering better results as you process more invoices.

2. Integration with Your Tech Stack

The best solutions integrate with your ERP, accounting tools, and document management systems. Seamless integration avoids silos, duplicate data entry, and manual workarounds.

3. Customization and Workflow Automation

An invoice processing solution that offers customizable workflows meets you halfway, eliminating the need to completely redesign your processes.

The ability to tailor workflows to your specific needs greatly enhances usability and increases the tool’s overall value for your business.

The ability to tailor workflows to your specific needs greatly enhances usability and increases the tool’s overall value for your business.

4. User Experience and Support

A user-friendly interface ensures quick onboarding for your team. Also, check for available support—live chat, onboarding training, and documentation can make or break adoption.

5. Scalability and Pricing

Ensure the tool can grow with your business. Some platforms charge per invoice, while others are user-based or tiered. Understand what’s included in each pricing tier and how costs scale over time.

6. Security and Compliance

Invoices often contain sensitive data. Choose a tool with enterprise-grade security features like encryption, access control, and audit logs to remain compliant with GDPR, SOC 2, and other regulations.

Conclusion

Adopting the right invoice processing software boosts efficiency, reduces errors, and cuts costs. Automation eliminates manual entry, speeds up approvals, and improves compliance, freeing your team for higher-value tasks. By assessing your needs, scalability, integrations, and security, you can choose a solution that streamlines accounts payable, saves time and money, and supports future growth.

Book a demo today and see how Docsumo can help your team save time, cut costs, and gain better control over your financial operations.